Native tokens for programmable blockchains play an essential role in their respective ecosystem, both for users and developers. Whether you are an experienced blockchain programmer who wants to utilize a new chain or aspire to become a Web3 developer, you need to understand the various blockchains’ tokens and standards so you can take full advantage of their respective strengths and weaknesses. Since there is an ongoing battle between Solana and Ethereum, comparing Solana and Ethereum tokens (SPL and ERC20) can give you a good idea of which assets could benefit your project the most. So, are you ready for the SPL vs ERC20 match? We’ll provide ringside seats herein as we compare SPL vs ERC20 tokens – let’s get ready to rumble!

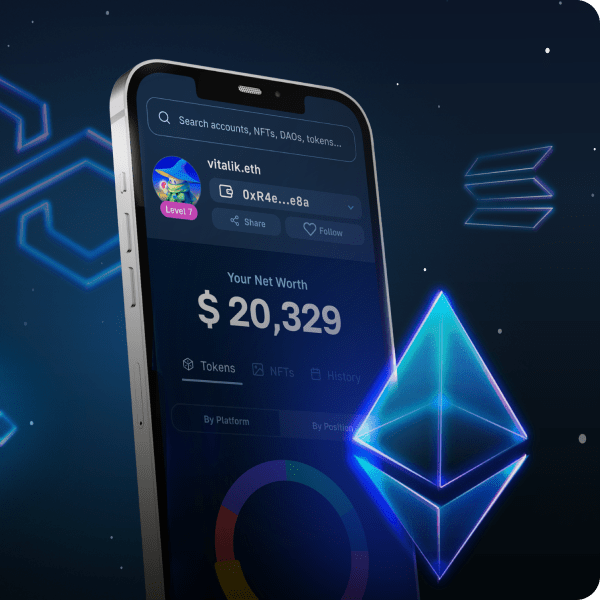

If creating SPL or ERC20 tokens is your top priority, this article is a great place to start. As we move forward, we will first cover the basics of Solana and Ethereum to ensure that we are all on the same page. Then, we will dive deeper into the SPL vs ERC20 tokens comparison. In addition, since NFTs (non-fungible tokens) continue to be all the rage, we will mention SPL and ERC NFT standards. Nonetheless, you’ll learn the simplest and fastest way to create Web3 applications that can utilize either SPL or ERC tokens. Thanks to the pinnacle of the current Web3 tech stack, Moralis, you can work with on-chain data easily. This ultimate Web3 backend platform helps you avoid dealing with the limitations of RPC nodes. Plus, you can index the blockchain effortlessly. So, make sure to create your free Moralis account today!

What is Solana?

Solana came to life back in 2017. It was launched by Raj Gokal and Anatoly Yakovenko, who are both still pretty involved with Solana. Yakovenko is Solana Labs’ current CEO and Gokal its COO. However, that still doesn’t cover the full scope of what Solana is. So, what is Solana?

Solana is an open-source, public programmable blockchain that supports smart contracts. As you may know, smart contracts are one of the key aspects of blockchain development. They’re the “engines” behind creating tokens and automating on-chain transactions. Furthermore, Solana enables devs to create fungible and non-fungible tokens and all sorts of dapps (decentralized applications). Moreover, Solana has its own native coin or token. The latter is the “SOL” ticker and has a two-fold purpose. First, it provides network security, which is done via Solana’s hybrid DeFi staking consensus. Second, SOL also serves as an agent for transferring value on the Solana chain. That includes covering transaction fees, known as gas.

When we focus on the consensus type, Solana is categorized as a proof-of-stake (PoS) chain but also uses a proof-of-history (PoH) consensus. In addition, Solana’s theoretical throughput is quite impressive. It is supposed to handle up to 65,000 transactions per second (TPS), making it one of the fastest chains in the Web3 realm. Aside from its speed, Solana also offers meager transaction fees. In most cases, gas fees are below one cent of a dollar. If you’ve experienced Ethereum’s exorbitant fees, you can already see Solana’s appeal and core advantage. Hence, speed and transaction fees also play a vital role in the SPL vs ERC20 tokens discussion. Nonetheless, we must point out that many skeptics continue to question Solana’s decentralization level.

Note: To explore Solana and its PoS/PoH hybrid protocol further, follow the “what is Solana?” link above.

What is Ethereum?

For a proper SPL vs ERC20 tokens discussion, you also need to know what Ethereum is. Ethereum was the first programmable chain, which launched back in 2015. Moreover, Ethereum remains the most popular blockchain network for deploying crypto tokens and dapps. Also, just like all programmable chains, Ethereum has its own native token or coin. The latter goes by the name of ETH (ether). ETH is a cryptocurrency with the second largest market cap, valued at about one-half of Bitcoin’s market cap.

Ethereum is also a decentralized public ledger that verifies and records transactions on its network (this is true for all public blockchains). In addition, “ethereum.org” points out that Ethereum provides open access to digital money and data-friendly services for basically anyone with internet access. Those users from all across the globe get to access this community-built technology and its countless applications. Using the Ethereum network, users can send their native cryptocurrency using Web3 wallets, such as MetaMask. Moreover, Ethereum can be used to send/receive other EVM-compatible tokens. The latter is available to anyone with an active ETH address.

Today there are countless Web3 applications in various sectors running on Ethereum. In theory, these dapps are accessible to everyone – there’s no censorship or centralized authority. However, the exorbitant gas fees limit access to wealthy users and developers. One of the reasons for high gas lies in Ethereum’s proof-of-work (PoW) mechanism. Moreover, dapps and token creation are powered by smart contracts on Ethereum. Essentially, smart contracts make sure that specific actions execute when certain predefined conditions are met. Thanks to Ethereum’s early start, it has an extensive worldwide community which gives the entire network its value.

Note: Explore our guide answering the “what is Ethereum?” question.

PoS vs PoW

Proof-of-stake (PoS) and proof-of-work (PoW) are the two common consensus protocols. In the case of PoW, the computing power of nodes ensures safety and verifies transactions. On the other hand, PoS does that based on staked tokens. As such, certain owners of native tokens on PoS chains need to pledge their coins to a validator, which is a computer (node). In the case of Solana, these computers run Solana’s software with its copy of the latest version of the chain. In turn, validators for PoS are the equivalent of miners on PoW chains. Moreover, PoS validators append the next block based on the details of their staking. The latter includes several criteria, although the amount and the period for which validators stake their tokens are normally the most important inputs.

With that said, you can see that PoS protocols are all about the level of commitment of network participants. Fortunately, this commitment is rewarded, so there are usually more than enough candidates to ensure the safety and proper mechanics of reputable chains. The level of rewards is mainly determined based on the number of native tokens and the commitment period. Furthermore, the level of decentralization in both types of protocols depends on the level of distribution of validators and miners. In addition, for PoS protocols, the ratio of staked circulating supply also plays a major role. As such, tokenomics for each chain must always be examined to get as clear of a picture as possible.

SPL vs ERC20 Tokens

Now that you all know what Ethereum and Solana are, you are ready to examine SPL vs ERC20 tokens. So, let’s start with some definitions:

- ERC – This abbreviation stands for “Ethereum Request for Comment”, which is how standards are named on Ethereum. Moreover, Ethereum standards are normally numbered. The most common standard is, without a doubt, ERC20. The latter revolves around token creation and handling on top of the Ethereum chain. Other popular standards focus on NFTs – ERC721 tokens and ERC1155.

- SPL – This abbreviation stands for “Solana Program Library” – Solana’s collection of on-chain programs. Those on-chain programs target the “Sealevel” parallel runtime – one of eight key Solana technologies. Moreover, a common implementation for fungible and non-fungible tokens on its blockchain is defined by Solana’s “Token Program”.

The above two definitions provide us with the basics of the SPL vs ERC20 tokens discussion:

- ERC tokens are crypto tokens created on the Ethereum chain.

- SPL tokens are crypto tokens created on the Solana chain.

When we talk about ERC20 tokens, we refer to fungible tokens on Ethereum. However, when it comes to SPL tokens, they cover both fungible and non-fungible tokens. As such, when we want to be more specific, we need to include either “fungible” or “non-fungible” in front of “SPL tokens”. Aside from the terminology, the main difference lies in the fact that SPL tokens exist on Solana and ERC tokens on the Ethereum chain. Thus, the mechanics of these tokens depend on the mechanics of the corresponding chains. This also determines how to store and handle tokens and how to create them. Also, they require different types of crypto wallets and different programming languages.

Handling SPL vs ERC20 Tokens

Unless you’ve been living under a rock, you must have heard of MetaMask before. The latter is the most popular hot crypto wallet for the Ethereum chain. As such, it natively supports the Ethereum mainnet and Ethereum testnets. In addition, it also supports all other EVM-compatible chains (e.g., BNB Chain, Avalanche, Polygon, etc.), which users can add to their MetaMask wallets. Thus, MetaMask is the tool for handling ERC20 tokens. However, this wallet doesn’t support SPL tokens. So, to handle SPL tokens, users need to use some other type of Web3 wallet. Of course, there are several options, yet the Phantom wallet remains the most popular choice.

The ability to handle tokens is something both users and developers need to master if they want to engage with blockchains. However, developers also need to learn how to create them. For those who wish to become a blockchain developer, keep reading as we decided to cover that aspect as well.

Creating SPL vs ERC20 Tokens

Creating SPL vs ERC20 tokens is the main difference between the two tokens. For one, as mentioned above, SPL tokens include both fungible and non-fungible tokens. However, when minting tokens on Ethereum, devs must pay attention to using the appropriate kind of contracts – ERC20 contracts for fungible tokens and ERC1155 or ERC721 smart contracts for NFTs.

Furthermore, when it comes to creating smart contracts, the two chains use different programming languages. When creating Ethereum and other EMV-compatible smart contracts, devs need to learn Solidity. On the other hand, Rust is the programming language for creating Solana smart contracts. So, one uses a special coding language created particularly for Ethereum development, while the other uses an existing programming language. Thus, if you’ve worked with Rust before, focusing on Solana might make a lot of sense for you. However, Solana SPL CLI tooling enables you to create tokens without Rust programming.

Moving forward, we encourage you to create your own ERC20 token and then a Solana token. As such, you will get a clear insight into their differences. When it comes to creating SPL tokens, you can use the video tutorial below starting at 5:48. Also, suppose you think Solana is the blockchain for you after completing this “SPL vs ERC20 tokens” journey. In that case, the video below will be hugely beneficial when creating not just a Solana token but a Solana token dashboard!

SPL vs ERC20 Tokens – Comparing Solana and Ethereum Tokens – Summary

At this point, you know that there are many nuances regarding the SPL vs ERC20 tokens comparison. In a way, the tokens have many similarities since they are both cryptocurrencies. However, since they are native tokens of different programmable blockchains, they differ in many aspects. For example, you need different crypto wallets to handle them and use different programming languages to mint them. However, there’s a silver lining amid the SPL vs ERC20 tokens discussion – Moralis. The latter offers you a full scope of tools that can help you out whether you decide to create SPL tokens or Ethereum tokens. You’ll see Moralis in its full glory when you decide to create killer dapps where users can utilize those tokens. For instance, you can build a Solana token dashboard in minutes.

If you want to learn how to work with Moralis, visit the Moralis YouTube channel and the Moralis blog. These outlets offer a ton of high-quality content, including countless example projects. Some of the latest topics focus on how to create your own metaverse, how to create a BNB NFT, how to build a P2E game smart contract, how to build a Uniswap DEX clone, how to get blockchain SMS notifications, how to add a Web3 connect wallet button to your website, how to get free Mumbai testnet MATIC tokens, NFT-based membership, and different NFT types, including fractional NFTs and dynamic NFTs. On top of that, we encourage you to consider enrolling in Moralis Academy. That way, you’ll be able to level up your blockchain development game with pro-grade courses, expert mentorship, and support from a fantastic community.