Odds are you’ve heard about DeFi. How about DeFi staking? The chances of you being familiar with these terms are pretty high. However, it turns out that most people lack a proper understanding of these relatively new financial concepts. Also, there is still a lot of uncertainty and gray areas in this space. Thus, we decided to create this full guide and answer the question many ponder, “what is DeFi staking?”. In a few minutes, you’ll have a much clearer understanding of the potential future of DeFi. So, what is DeFi staking? Let’s find out, shall we!

We want to point out that there are countless investment opportunities involving DeFi. But, the most significant potential awaits blockchain developers who will help build dapps (decentralized applications) to ensure DeFi goes mainstream. With the knowledge obtained in this article, you can easily put your frontend development skills to the test and start building DeFi staking dapps. With the ultimate Web3 development platform, Moralis, you can get straight to the point. This “Firebase for crypto” operating system lets you create phenomenal Web3 applications in minutes. In addition, this advancing Web3 backend platform covers all your backend needs. As a result, you can focus on creating the best possible Web3 UI. Thus, create your free Moralis account today! However, the mission of today’s guide is to tell you what DeFi and DeFi staking involves. Plus, we’ll also discuss the mechanics of DeFi staking and its existing use cases herein.

What is DeFi?

Before we can talk about DeFi staking, we need to ensure that you all know the basics. Decentralized finance, or DeFi, is a relatively new term that came to life back in August 2018. However, while the term was born during a Telegram chat between Ethereum developers and entrepreneurs, the concept of DeFi dates back to 2009. This was Bitcoin’s inception, and Bitcoin was the first public distributed ledger (blockchain). Furthermore, Bitcoin (the chain) also came with its native cryptocurrency, BTC (Bitcoin). Nonetheless, Bitcoin was created to support peer-to-peer (P2P) transactions. Moreover, since transactions are a pretty important part of the financial ecosystem, we can consider this as the beginning of DeFi.

However, it wasn’t until the first programmable blockchain, Ethereum, that DeFi in its full glory became possible. As you may know, the pieces of software that make interaction with programmable blockchains possible are smart contracts and dapps. Smart contracts exist to ensure that on-chain transactions run according to standards and protocols. As such, predefined actions execute when predefined conditions are met. Moreover, dapps ensure that users get to interact with chains.

With that in mind, the main idea of DeFi is to offer all the useful concepts of traditional finance (TradFi) and make them decentralized. That is, to make them propelled by distributed pieces of hardware and eliminate countless middlemen attached to the traditional financial system. Of course, not all DeFi applications are equally decentralized; thus, centralized finance (CeFi) is also a thing. There’s also the question of proof-of-work (PoW) vs proof-of-stake (PoS) blockchain mechanisms. However, let’s leave these details for a later discussion. So, since DeFi uses existing financial concepts, it seems fair to do a quick overview of traditional finance.

A Quick Overview of Traditional Finance

Banks are at the core of the traditional financial system. These centralized corporations, whose goal is to make more money, hold most people’s money. Aside from banks, traditional finance is full of third-party facilitators. The latter are involved in moving the money between two parties. You’ve guessed it – they all charge fees.

So, let’s look at an example transaction. Let’s say you use your credit card to buy a loaf of bread in a local store. The transaction goes from the merchant to an acquiring bank. The latter forwards the card details to the credit card network, which needs to clear the charge and request a payment from your bank. Next, your bank approves the charge and sends the approval back to the network via the acquiring bank to the merchant. Of course, along the way, all entities involved charge their fees. Hence, all transactions cost money. Not to mention that this process can be pretty slow. The same is true for other types of transactions and interactions with traditional finance. That is especially true when we look at loan applications.

Aside from the problem of countless middlemen in traditional finance, banks are fully controlling your money. They can block your accounts at any time. Moreover, due to different systems and policies, your cards may not function in certain countries. However, lending, borrowing, trading, savings, and buying derivatives are all mechanisms of traditional finance. In fact, the entire Wall Street is a part of traditional finance. So, ideally, DeFi would take all these concepts and make them available to anyone with an internet connection and a Web3 wallet. There are many instances of this theory already being exercised, with DeFi staking being an important part of it.

What is DeFi Staking?

Now that we all have a solid understanding of what DeFi is, it’s time to zoom in on DeFi staking. So, what is DeFi staking? This concept evidently has something to do with decentralized finance and staking. Further, there are two different interpretations of DeFi staking. If we consider the concept in its most “to-the-point” definition, it focuses on staking crypto assets in order to become a validator in a layer-1 blockchain or a DeFi protocol. By “staking crypto assets”, we refer to locking fungible or non-fungible tokens (NFTs) into smart contracts. Moreover, in exchange for staking crypto assets, users earn rewards for the duties their staking performs. On the other hand, if we look at DeFi staking from a broader perspective, it refers to all sorts of DeFi activities that involve a temporary commitment of crypto assets.

The Mechanics of DeFi Staking

The purest form of DeFi staking refers to users locking a specific amount of native tokens or coins to become a validator in a PoS (proof-of-stake) blockchain network. Moreover, PoW consensus algorithms require computing power to validate transactions, which consumes energy and has a larger carbon footprint. On the other hand, the PoS mechanisms rely on validators with a vested interest in the given chain. Validators who stake their assets are inclined to perform their duties properly to avoid the risk of losing a portion of or even their entire stake. Of course, there are also staking rewards that further encourage validators to create and validate blocks.

There are many PoS blockchains (e.g., Polkadot, Algorand, Solana, Cardano, etc.). However, even the most high-profile programmable blockchain, Ethereum, is in the middle of its transition from PoW to PoS (Ethereum 2.0). Moreover, if we boil it down to basics, the DeFi staking process requires a party interested in becoming a network validator. That party needs to post a “bond” (stake), making it eligible for staking rewards.

Unfortunately, this direct staking approach often has relatively high staking requirements, which is out of reach for many investors. However, several staking service providers came up with a solution in the form of “staking pools”. The latter is also available through various centralized and decentralized exchanges. As such, users can form larger groups and, in turn, smaller investors get to participate in staking.

Why is DeFi Staking Used?

Now that you’ve taken a closer look at the core concept of DeFi staking, you already understand that it’s used to provide security to the network. By randomly selecting the DeFi staking participants, they essentially validate or “mine” the block in question. Although, the details of PoS mechanisms vary among different chains. Also, we have to consider the broader definition of DeFi staking. In that case, staking can serve to provide liquidity for specific trading crypto pairs. It can also be used to ensure that the value of a certain project or cryptocurrency doesn’t drop. Furthermore, when platforms are in question, staked assets can be used for other purposes. Hence, the “why is DeFi staking used” range can greatly vary from one DeFi platform to another.

Benefits of DeFi Staking

Since our DeFi staking discussion is based on two different ways of looking at this DeFi principle, the benefits vary as well. For instance, if we focus on staking related to validators of PoS chains, the main benefit is security and the chain working properly. Of course, a large amount of staked native tokens also helps prevent the price of a cryptocurrency from dropping too extremely. In addition, compared to PoW, PoS brings the benefit of a lower environmental impact.

The benefits also differ depending on the point of perspective. As such, let’s look at the benefits of DeFi staking for those staking, the staking platforms, and DeFi ecosystems:

- Benefits of DeFi Staking for Stakers:

- An easy way of earning a passive income.

- Stakers are normally offered low entry fees.

- It is usually pretty simple to get started.

- With the interest rate in mind, rewards are normally higher than expected.

- Where proper smart contracts are used, stakers are highly secured.

- Benefits of DeFi Staking for Staking Platforms:

- Increased liquidity.

- An attractive service they get to offer to their users.

- Revenue from stakers and networks.

- Benefits of DeFi Staking for Tokens/Protocols/Blockchain Networks:

- Pretty dynamic token market capitalization and liquidity.

- Much lower energy consumption for validating blocks.

- DeFi staking also helps maintain liquidity.

From TradFi to CeFi and DeFi

Despite the many obvious benefits of DeFi staking, to think that all existing corporations will allow a smooth transition into DeFi would be foolish. Furthermore, many users are afraid of the unknown that the new technology is bringing to the table. As such, we can most likely expect some sort of mix between traditional finance and DeFi in the near future. In fact, we can already see this expressed with several centralized exchanges, which are the core of CeFi. In a way, you can view them as banks on blockchain.

Current DeFi and CeFi users represent less than 5% of the global population. As such, we are still far from mainstream adoption. In the future, users that do not want the highest levels of control over their finance will most likely continue to use the modernized banks or centralized exchanges, which will be the core of CeFi. On the other hand, there will be many folks who like being in maximum control of their lives who will opt-in for DeFi services.

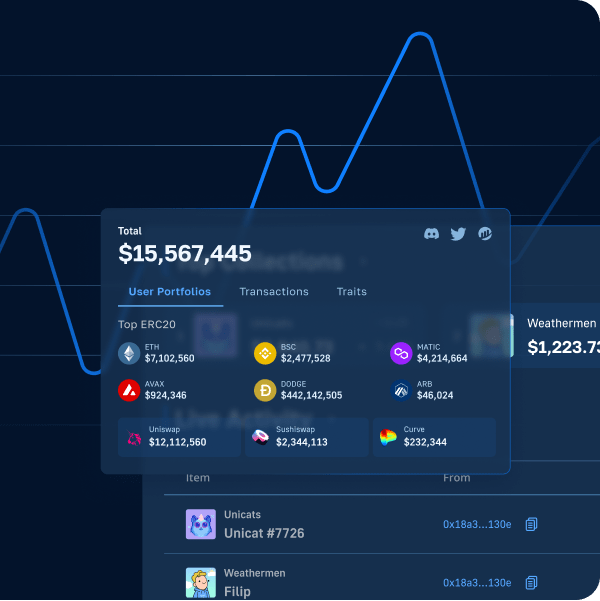

In our opinion, we should all aim for DeFi to be the leading form of future finance. At least, in theory, this concept offers a much more “just” world. Hence, it is up to you, our next-gen blockchain developers, to create user-friendly DeFi platforms. Keep in mind that seamless user experience is the key to mainstream adoption of DeFi. Fortunately, Moralis makes it possible to devote your maximum attention and resources to creating the best frontend. So, make sure you check out how to create a DeFi dashboard without breaking a sweat. Use Moralis and be a part of this world-changing evolution of finance and the internet!

What is DeFi Staking? – Full Guide – Summary

You now know that DeFi staking is the core aspect of the PoS consensus mechanism. You’ve also learned about other DeFi staking use cases. In addition, you’ve discovered the benefits of DeFi staking. Nonetheless, along the way, you’ve briefly looked at Moralis, the pinnacle of the current Web3 tech stack. As such, you know where to start your journey of creating phenomenal DeFi dapps or other types of Web3 apps. If you’d like to take your DeFi knowledge further, we recommend learning about flash loans and DAO smart contract examples.

Let’s remind you that the best way to get into Web3 is to become a blockchain developer, especially if you are JavaScript or Unity proficient. If so, you can immediately tackle more advanced projects with Moralis’ SDK. Furthermore, if you want to continue your free crypto education, the Moralis blog and the Moralis YouTube channel are the places to be. Both of these outlets provide a ton of quality content, including many example projects. For instance, some of the latest topics focus on how to build a metaverse game, how to communicate with a Web3 database from Unity, why Web3 is important, how to store off-chain data, how to reduce Solidity gas costs, how to create an Ethereum NFT, how to build a 2D Web3 game, how to create a GameFi game, and much more.

However, if you want to become a Web3 developer as soon as possible, you may want to consider enrolling in Moralis Academy. Aside from accessing high-quality courses, you will become a part of an amazing community, get a personalized study path, and get expert mentorship.