In short, cross-chain bridges enable users to transfer tokens and data between blockchains. That said, the fundamentals of these bridges go beyond that initial explanation and can be pretty complex. Unfortunately, many who want to find a straightforward answer to what cross-chain bridging is and how bridges work often encounter complicated articles, leaving readers with more questions instead of understanding the topic. Thus, if you want a simple yet thorough answer to the “what is a cross-chain bridge?” question, this article is for you!

Moving forward, we’ll start with the basics, first explaining what cross-chain bridging is. Next, we’ll answer the “what is a crypto bridge, and how does it work?” question. Then, we’ll take a look at the benefits of these bridges. You’ll also have a chance to meet some of the most popular cross-chain bridge solutions in this article. Last but not least, we’ll focus on development. This is where you’ll learn about the ultimate Web3 API provider, Moralis. After all, the latter is the leading Web3 tool for creating dapps (decentralized applications), which you may use to create a crypto bridge.

Nonetheless, if you possess solid programming skills and want to start using Moralis’ cross-chain APIs directly, feel free to jump straight into “BUIDLing”. You only need your free Moralis account and the Moralis docs to start!

Cross-Chain Bridging – What is it?

Cross-chain bridging means transferring crypto assets and information between independent blockchains, enabling users to access and interact with different protocols. As you may know, layer-1 (L1) blockchains are separate networks not able to communicate with each other. For instance, you can’t use SOL on Ethereum or ETH on Solana, which can be pretty off-putting for average Joes and Janes from the legacy Web2 ecosystem.

Of course, things were quite simple in the early stages of Ethereum. After all, Ethereum – the first programmable chain – was focused on dapp development, while Bitcoin served for high-value transfers. As such, there was no actual need for cross-chain bridging. However, the Ethereum chain couldn’t successfully manage the high interest that devs displayed in Web3 development. Plus, many users couldn’t afford the exorbitant gas fees when the network was busy. Thus, many so-called “Ethereum killers” emerged. In addition to many new L1 blockchains, some teams also focused on creating layer-2 (L2) chains. As a result, there are now over 125 blockchains, and most of these chains come with their native cryptocurrencies. Consequently, solutions and tools that support interoperability for all these chains are in high demand.

Before cross-chain bridging, you had to do more than transfer assets from one chain to another. That wasn’t just the case for L1s. In fact, you couldn’t do that even between L2s and their base L1s. Before cross-chain bridge solutions, you had to use centralized exchanges to exchange assets and then transfer them to another chain (see the example below). This was not only time-consuming but also resulted in wasting money on fees.

Cross-Chain Bridging – Before Cross-Chain Bridges Existed

So, let’s say you had some funds on Ethereum and wanted or needed to use a layer-2 such as Polygon (formerly Matic). The best way to transfer your funds from Ethereum to Matic before cross-chain bridges would be to use a centralized exchange (CEX), such as Binance or Coinbase. There you’d use the ETH-MATIC trading pair (if available). Otherwise, you’d have to exchange ETH for BTC or USDT and then use that BTC or USDT to buy MATIC. Finally, you’d be able to withdraw your MATIC to its L2 chain.

That said, let’s look at what a crypto bridge is and how it works!

What is a Crypto Bridge and How Does it Work?

If you covered the above section, you’ve probably already formed your answer to the “what is a cross-chain bridge?” question. As such, you most likely understand that a crypto bridge is a solution for developers, investors, and all other blockchain users to transfer digital assets from one chain to another effortlessly. In addition, cross-chain bridge solutions come in different forms, such as dapps, development platforms, or Web3 wallets. In short, a crypto bridge for users is usually a dapp, and for developers, it’s usually a platform or service enabling devs to add multiple networks to their dapps. Furthermore, since all cross-chain bridges need to execute on-chain transactions, smart contracts are involved. As such, cross-chain bridge development also requires creating and deploying Web3 contracts.

Now that we’ve answered the “what is a cross-chain bridge?” question, let’s focus on how it works. Nonetheless, it’s important to note that there are different types of cross-chain bridge solutions, as mentioned previously. Accordingly, the exact mechanisms behind the process of cross-chain bridging can vary.

Cross-Chain Bridging – How an Average Crypto Bridge Works

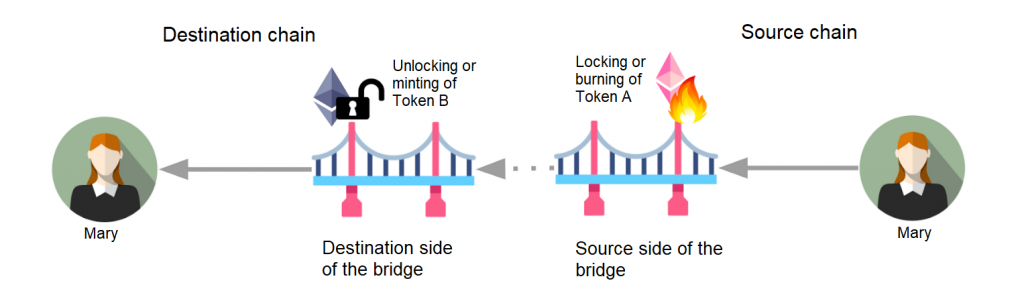

Let’s say Mary has native “Token A” assets on the source chain but wants to use her funds on another chain:

- Mary sends a certain amount of Token A to a specific blockchain address on the source chain and pays the transaction fee.

- A smart contract (owned by a trusted validator or custodian) locks the amount of Token A that Mary sent.

- Another smart contract mints equivalent units of Token B on the destination chain.

- Mary then receives Token B in her wallet address. She can freely use Token B to execute transactions on the new blockchain.

Understanding the above process before using cross-chain bridges is important, especially if you plan on diving into cross-chain bridge development. Also, note that if you try sending non-supported tokens to blockchains, your transactions will fail, or you may even lose your funds.

So with the above explained, another question worth addressing is, “what is a cross-chain bridge’s core mechanism?”. In short, it is a smart contract that “wraps” incoming tokens to issue native assets that can be used on the destination chain. For instance, you’ve probably heard of wrapped BTC (wBTC). The latter is, in many cases, an ERC-20 token that uses BTC as collateral. Further, users send BTC and receive wBTC, which they can use on the Ethereum blockchain. Moreover, another popular wrapped token is wETH, which is a “bridged” version of ETH on other EVM-compatible chains, such as Avalanche, Arbitrum, etc.

Nonetheless, the exact tokens that can be “transferred” using cross-chain bridges depend on the details of different cross-chain bridge solutions.

The Benefits of Crypto Bridges

Now that you know the answer to what a cross-chain bridge is and how it works, it’s time to look at some benefits of cross-chain bridge solutions. If crypto bridges are designed correctly, they offer the following pros:

- Make Assets More Productive – As DeFi evolves, more and more types of staking alternatives emerge. Services such as yield farming, staking, and lending offer countless opportunities on multiple networks. With crypto bridges, users can utilize as many platforms as they want on various networks. Another great example is using NFTs on different chains as collateral.

- Offer Better User Experience – In the last couple of years, the crypto realm has become much more user-friendly. Moreover, the fact that users can bridge their assets between different chains is a great contributing factor. After all, the conversion process without a crypto bridge described above is quite off-putting.

- Help Maximize Liquidity – As you may know, crypto is still in its infancy, and the number of users can be quite limited. As such, it’s beneficial if users can use their assets across different chains, which can help improve liquidity. After all, ETH and BTC are still the dominant cryptocurrencies, and being able to bridge them to other upcoming chains can be highly beneficial.

However, we must also point out that attackers can exploit any imperfections in cross-chain bridge development. In fact, most recent crypto attacks occurred because of flaws within cross-chain bridges and their development structure. On a positive note, this tells us that there’s room for improvement and that Web3 developers are in high demand.

Cross-Chain Platforms

If you really want to grasp the concept of cross-chain bridging, you should take some popular cross-chain bridges for a spin. As such, test out some of the below-listed bridges just to get the hang of how cross-chain bridge platforms work. Please note that if you test out any of these bridges, you do so at your own risk.

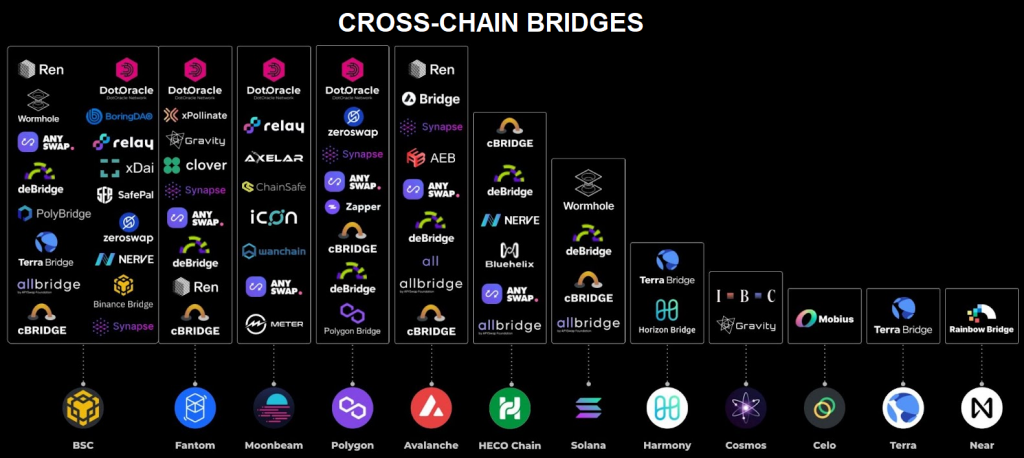

Moreover, note that there are many crypto bridges at your disposal, especially for the most popular chains:

It was challenging to decide which cross-chain bridge solutions to list in this article. Yet, here are the ones we believe deserve your attention:

- Polygon PoS Bridge – Focuses on bridging Polygon (L2) and the Ethereum mainnet (L1)

- Binance Bridge – Focuses on bridging BNB Chain and Ethereum

- Synapse – Supports multiple chains

- Wormhole – Primarily focuses on bridging Solana and Ethereum

- Ren Bridge – Supports multiple chains

Aside from cross-chain bridges, there are many cross-chain platforms and dapps that you can explore. In most cases, you’ll need a Web3 browser, such as Brave, and your Web3 wallet, such as MetaMask. Then, if you see that a dapp enables you to select different chains, it means that it is cross-chain interoperable. Moreover, if you’d like to build such dapps, Moralis’ Web3 APIs can help you get to the finish line with time and resources to spare.

The #1 Alternative of all Cross-Chain Functionality Solutions

The way things currently stand, a cross-chain future seems inevitable. Limiting your Web3 development to any particular chain doesn’t make sense. Of course, this may sound challenging and complex as you probably think such an approach requires you to master a wide range of tools. However, thanks to Moralis, cross-chain bridge development becomes as straightforward as it gets.

After all, Moralis supports all leading blockchains, with full support for new reputable chains constantly added. Hence, with Moralis, you future-proof your dapp development by never getting stuck to any particular chain. Moreover, you can offer your users to switch between various chains, or you could focus on one of the supported chains to start. Then, you could tweak a single line of code and transition to another chain if the need arises.

Moralis is also all about cross-platform interoperability. You can start creating killer dapps using your favorite programming languages and dev platforms. In fact, Moralis is sort of a “crypto bridge” itself, as it bridges Web2 and Web3 by enabling you to use legacy dev tools to join the Web3 revolution.

With your free Moralis account, you can access the Moralis toolbox of ultimate Web3 APIs. These include an EVM API, Solana API, NFT API, Auth API (Web3 authentication solution), Streams API, and Token API. So, whether you want to focus on cross-chain bridge development or create other excellent dapps, the power of Moralis makes things a lot simpler.

Cross-Chain Bridging Deep-Dive – Summary

We covered quite a distance in today’s article. Ultimately, you had a chance to go from learning about the basics of cross-chain bridging to learning how this process works and which crypto bridges you may want to test. Along the way, you also learned the key benefits of these cross-chain solutions. Last but not least, you found out that cross-chain development is much more accessible than most devs think. Of course, if you want to focus on cross-chain bridge development, you must also work with smart contracts. However, to create multi-chain dapps, a combination of Moralis’ Web3 APIs and a set of your favorite legacy tools is all you need.

If you want to start building cross-chain dapps the easy way, create your free Moralis account. Also, follow along with one of our excellent tutorials to see how Moralis’ cross-chain functionality works. You can find tutorials in Moralis’ documentation, the Moralis YouTube channel, and the Moralis blog. The latter is also a great place to expand your blockchain development knowledge for free. For instance, some of our latest articles teach you how to create a Web3 Firebase login with MetaMask, how to create a decentralized website on Ethereum, how to get started with Solana smart contract building, how to add dynamic Web3 authentication to a website, and much more.

On the other hand, you may be interested in going full-time crypto as soon as possible. In that case, you may want to become blockchain certified, which significantly improves your chances of landing your dream job within Web3. If that resonates with you, consider enrolling in Moralis Academy. You can choose between beginner, intermediate, and advanced courses. However, if you are new to crypto, start with the “Blockchain & Bitcoin 101” course.