DeFi – short for ”decentralized finance” – is an umbrella term for financial services running on blockchain networks. For example, this can include lending, borrowing, spot trading, and insurance-related services. Today, DeFi represents one of the most significant sectors within the Web3 space, and the DeFi industry continues to grow on a daily basis. As such, becoming a DeFi developer is an excellent career choice. However, what exactly is decentralized app development? And how does it work? If you’re looking for the answers to these queries, join us in this article as we explore the ins and outs of DeFi dapp development!

Overview

We’ll kickstart today’s article by returning to basics to answer the question, “What is DeFi?”. From there, we’re also going to dive a bit deeper into decentralized applications or dapps to explain what they are and how they work. Next, we’ll jump into DeFi dapp development to briefly cover the process of creating DeFi platforms. We’ll then explore a few benefits of DeFi dapps and dive into some prominent examples of existing projects. From there, we’ll briefly explain what it takes to start with decentralized app development. Lastly, we’ll introduce you to Moralis’ industry-leading suite of Web3 APIs, as this is the easiest way to build DeFi platforms!

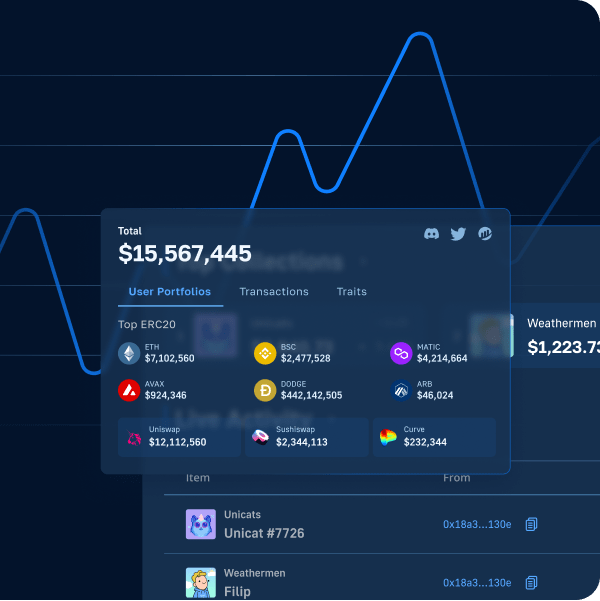

In Moralis’ premier Web3 API suite, you’ll find multiple interfaces for different use cases. Some prominent examples include the Wallet API, NFT API, etc. With these tools, you can effortlessly build everything from decentralized exchanges (DEXs) to lending platforms. As such, with Moralis, it has never been easier to get into DeFi dapp development.

Also, did you know that you can access our premier interfaces for free? All you have to do is sign up with Moralis, and you’ll be able to build your first project in a heartbeat!

What is DeFi?

DeFi is an abbreviation for ”decentralized finance”, and it’s an umbrella term for financial services running on blockchain networks like Ethereum, BNB Smart Chain (BSC), Polygon, Solana, etc. The DeFi space is quite extensive, and there are platforms providing most of the common services that conventional banks and other institutions offer – including borrowing and lending, spot trading, buying insurance, etc.

However, since DeFi is based on peer-to-peer (P2P) blockchain networks, the industry removes the need for third-party and intermediary involvement in financial transactions!

But how is this possible?

Rather than relying on traditional institutions and their employees to validate transactions, DeFi platforms leverage smart contracts – also known as Web3 contracts – instead. Smart contracts are basically programs running on blockchain networks that execute whenever predetermined conditions are met. This makes smart contracts ideal for automating processes such as financial transactions.

As such, smart contract technology completely shifts the fundamental trust model for financial services from reliance on intermediaries to trust in code residing on blockchain networks. What’s more, as with crypto in general, DeFi is global, pseudonymous, decentralized, and open to everyone across the entire globe!

What is a Dapp?

Applications and software – such as DeFi platforms – built with smart contracts are often referred to as decentralized applications (dapps)!

But what exactly are dapps? And how do they work?

Decentralized applications – commonly known as dapps – represent a new generation of web-based apps built using decentralized technologies such as P2P blockchain networks and smart contracts. Consequently, dapps – unlike most conventional applications – are free from the control and influence of central authorities.

However, dapps aren’t all that different from traditional applications when it comes to the user experience. And they typically serve the same purpose and provide similar functionality. As such, if they are well-designed, the end user shouldn’t be able to tell the difference.

In short, the main distinction between dapps and traditional apps is that dapps use decentralized P2P blockchain networks for their backend operations and leverage smart contracts to cut out unnecessary intermediaries!

Nevertheless, that gives you a brief overview of what dapps are. For a more in-depth explanation of this new generation of applications, check out our ”What are dapps?” article!

In the next section, we’ll explore what DeFi dapp development entails!

What is DeFi Dapp Development?

Now that you have familiarized yourself with DeFi and dapps, you might be interested in building something yourself. As such, we’ll give you an overview of DeFi dapp development in this section!

So, what is DeFi dapp development?

Put simply, DeFi dapp development is the process of creating DeFi dapps. However, this is quite self-explanatory and doesn’t say all that much. As such, let’s briefly look into the typical steps of the DeFi dapp development process to give you an overview of what it entails:

- Market Research: The first step in any DeFi dapp development endeavor should be research to identify gaps in the existing market.

- Project Specifications: Once a gap has been identified, the next step is to shape the idea into a technical plan.

- Frontend Design: With a plan at hand, it can be beneficial to start with the design of the user interface (UI) and user experience (UX), as a broad overview of the frontend can be a vital component in how the project’s backend is structured.

- DeFi Dapp Development: The next step is to undertake all the technical work, including infrastructure development and blockchain engineering. What’s more, this, for instance, involves critical steps such as smart contract development.

- Testing: Once a minimum viable product (MVP) is ready, it’s time to test the project to identify bugs and errors.

- Deploy the Project: Once the DeFi dapp is ready, the next step is to deploy the project to the blockchain.

- Maintenance and Support: With the DeFi dapp up and running, the final part of the development process is maintenance and support.

Nevertheless, that gives you an overview of the typical DeFi dapp development process. However, this is an example, and some of the steps above can change depending on the development team’s preferences and other factors.

Why Build DeFi Dapps?

Now, with an overview of what DeFi dapp development entails, you might still be asking yourself, ”Why should I build DeFi dapps?”. Well, to answer this question, let’s look at a few benefits of dapps:

- No Single Point of Failure: Since DeFi dapps are decentralized, there’s no single point of failure. This, for instance, makes dapps more reliable, more challenging to hack, and censorship-resistant.

- Openness: Dapps are typically completely open and permissionless. This means that anyone can use them and often doesn’t even need an account, making onboarding super easy. Instead, users only require a Web3 wallet to interact with all dapps on a blockchain network.

- Pseudonymous: With dapps, users generally don’t need to provide names, email addresses, or any personal information at all.

- Transparent: Public blockchain networks are typically entirely transparent. As such, when using dapps and other Web3 platforms, everyone involved can see the full set of transactions.

- Cost-Effective: Since dapps leverage smart contract technology, there’s no need for third-party involvement. As a result, there are no intermediaries that charge for their services, which can make the usage of dapps cheaper compared to conventional applications.

Nevertheless, that covers a few prominent benefits of why you should build DeFi dapps. In the next section, we’ll explore DeFi dapps further by looking at some prominent examples of already existing platforms!

DeFi Dapp Examples

There are many different types of DeFi dapps ranging from decentralized exchanges (DEXs) to lending platforms. In this section, we’ll explore three prominent examples:

- Uniswap: Uniswap was launched in 2018, and it’s an industry-leading DEX for swapping cryptocurrency tokens on Ethereum and other prominent blockchain networks. Since the platform’s launch, Uniswap has processed over 160 million transactions, with the total trading volume exceeding $1.5 trillion.

Moreover, since Uniswap is decentralized, there isn’t a single entity in control of the platform. Instead, Uniswap is governed by a global community of UNI token holders and delegates, with UNI serving as the protocol’s governance token.

- Aave: Aave is a decentralized, non-custodial, open-source liquidity market protocol where users can participate as suppliers or borrowers. Suppliers are responsible for providing liquidity to the market to earn passive income, while borrowers can lend undercollateralized or overcollateralized.

Much like Uniswap, Aave also features a governance token called AAVE. AAVE has two central functions. First of all, it is used to govern the protocol. As such, AAVE token holders can vote on improvement proposals and decide how the Aave protocol will progress moving forward. Second, AAVE can also be staked, where stakes earn rewards and fees from the protocol.

- Compound Finance: Compound Finance is an Ethereum-based decentralized borrowing and lending platform launched in September 2018. With Compound, lenders can deposit assets into liquidity pools and earn interest in return. Borrowers can then take out loans in exchange for paying interest. And this entire process is handled by smart contracts, eliminating the need for intermediaries.

Furthermore, Compound Finance provides a token called Compound (COMP). This is an ERC-20 token, and holders debate, propose, and vote on changes to the protocol.

To explore more DeFi protocols, check out the DeFi dapps page inside Moralis’ dapp store!

How to Get Started with DeFi Dapp Development

DeFi dapps generally comprise three central parts: a frontend, smart contracts, and a backend. Consequently, to start with DeFi dapp development, you need the basics of building these three components. And let’s briefly start with DeFi dapp frontend development:

- Frontend: DeFi dapp development doesn’t differ all that much from conventional Web2 practices when it comes to the frontend. Consequently, when building DeFi dapps, you can leverage many of the same tools and languages, including JavaScript, HTML, CSS, and so on.

- Smart Contracts: When it comes to smart contract development, you typically need to grasp the basics of Solidity. Solidity is a so-called contract-oriented programming language, and it’s specially designed for creating EVM-compatible smart contracts.

What’s more, there are many tools worth using that can make smart contract development significantly more accessible. Check out the Web3 Wiki page for Solidity tools to learn more about this!

- Backend: Backend development has, at least from a conventional perspective, been the most cumbersome task of decentralized app development. It has typically required developers to set up infrastructure for communicating with the various blockchain networks and smart contracts to, for instance, fetch essential on-chain data. Fortunately, there are now tools you can use to leverage already-built backend infrastructure to avoid reinventing the wheel. And the best tool for this is Moralis!

As such, if you want a straightforward and powerful tool for communicating with various blockchains, we highly recommend checking out Moralis. And to learn more about this, join us in the next section as we explore this industry-leading DeFi dapp development tool!

Also, if you want to learn more about what it takes to start with decentralized app development, check out our more comprehensive guide on Web3 development and how to learn it!

Moralis – The #1 Tool for DeFi Development

Moralis is an industry-leading Web3 API provider, and with our premier interfaces, you get all the data you need in one place. As such, with Moralis’ cross-chain compatible Web3 API suite, it has never been easier to build DeFi dapps such as DEXs, lending platforms, and decentralized autonomous organizations (DAOs)!

So, why should you leverage Moralis in your decentralized app development endeavors?

To answer this question, let’s look at three prominent benefits of Moralis!

- Top Performance: Moralis’ Web3 APIs ensure top performance. It doesn’t matter if you want to judge by speed, reliability, or pricing; our interfaces continuously blow the competition out of the water.

- Multiple Interfaces: In our suite of premier Web3 APIs, you’ll find an interface for every use case. For instance, if you want to build your own DeFi dapp, then you can get a lot of the functionality you need from the DeFi API. Or, if you’d like to build an on-chain wallet tracker, you can seamlessly set up real-time alerts with the Streams API.

To learn more about all available tools, check out our Web3 API page!

- Trusted by Industry Leaders: Moralis’ Web3 APIs are trusted by industry leaders, including MetaMask, Polygon, Tryhards, NFTrade, and many others. Just check out a couple of testimonials below:

So, no matter which of the biggest and most popular blockchains you want to build on, make sure to check out Moralis. You can sign up with us for free, and you’ll get immediate access to all our industry-leading interfaces!

Summary: What is DeFi Dapp Development?

In today’s article, we kicked things off by exploring the ins and outs of DeFi. In doing so, we got to learn that it’s an umbrella term for financial services on blockchain networks like Ethereum.

Moreover, we also explored the ins and outs of decentralized app development, where we discovered that it typically involves everything from market research, frontend/backend development, etc., to maintaining the dapp once it’s launched.

From there, we also dove into the benefits of building dapps compared to conventional applications and explored three prominent examples of existing platforms: Uniswap, Aave, and Compound.

Lastly, we covered a few things you need to get started with decentralized app development. And in doing so, we introduced you to Moralis – the ultimate tool for building DeFi platforms!

If you liked this DeFi dapp development article, consider checking out more content on the Web3 blog. For instance, explore the best free NFT tools or get some inspiration from our list of smart contract ideas.

Also, if you’re serious about getting into decentralized dapp development, don’t forget to sign up with Moralis. You can set up your account free of charge, and you’ll gain immediate access to all our premier Web3 APIs!